33// UTMB’s Balance Sheets Illustrate the Growth of Ultra Running

On the finances behind UTMB’s growth

Hey pals,

You don’t need to be in Chamonix this week to know how big UTMB is.

Their seismic growth over the past two years has been remarkable. It get’s even more impressive when you take a look under the hood at their balance sheets. Which this week, i did. It should be noted that UTMB Group refutes some of the figures mentioned in the article.

Hope you enjoy,

Matt

2020 was a rough year for UTMB. With the ongoing pandemic curtailing runners ability to travel to races, UTMB cancelled their biggest event UTMB Mont Blanc. After only organising a few races that year UTMB struggled to generate €1.7M, half of what it would do it in a normal year.

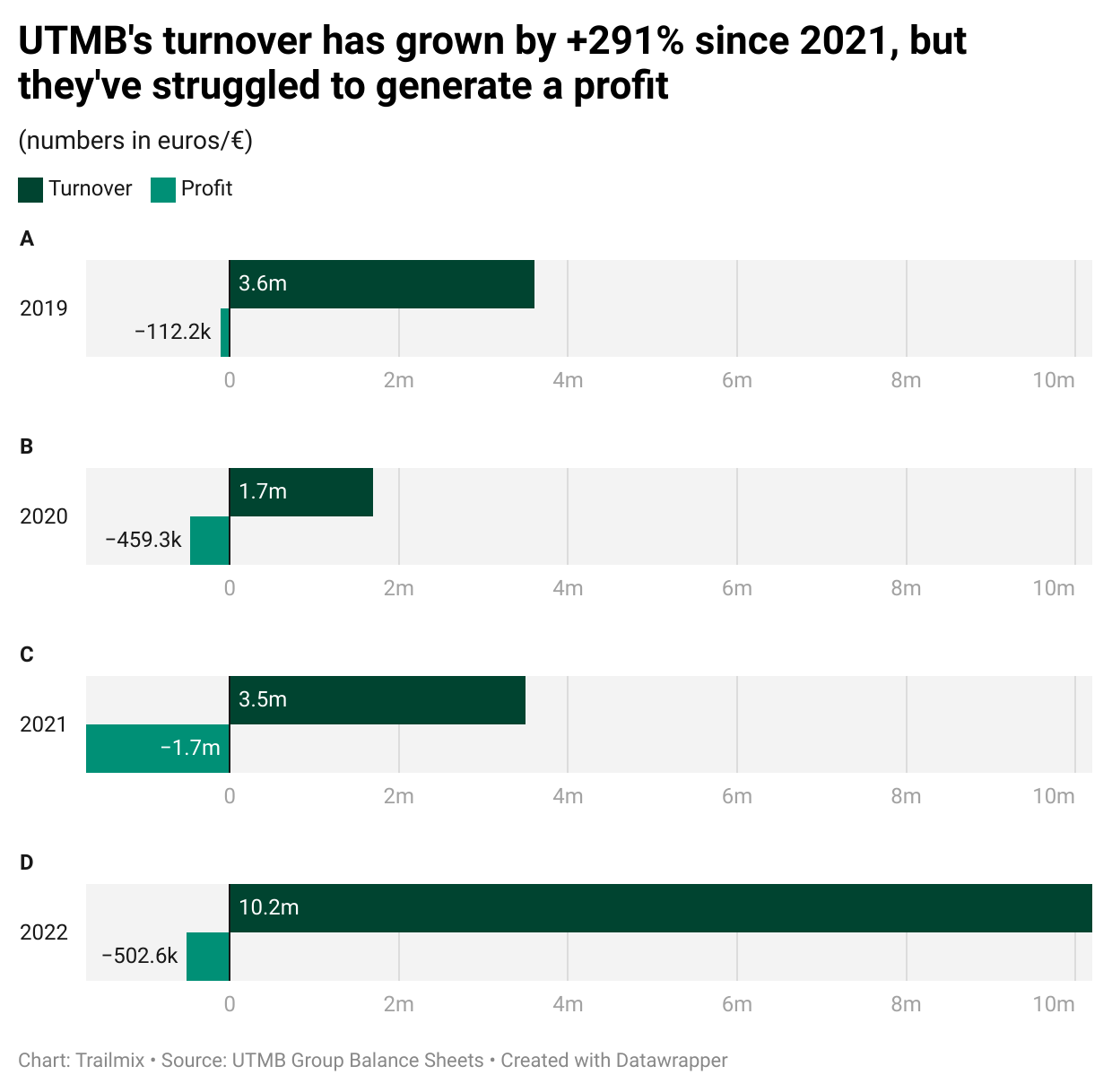

Ever since then, following the Ironman partnership and World Series expansion, UTMB group has grown to generate over €10M euros in 2022, a 600% increase in turnover in 2 years. And whilst their 2022 balance sheet released last month shows they did not generate a profit in that time period, they will be profitable this year, according to Frederic Lenart, General Manager of UTMB Group.

When put in context, UTMB’s balance sheets from the last 4 years show the extraordinary growth of an industry and gives perspective to how large ultra running has become. And yet, we still don’t know how big it actually is.

UTMB Group have only recently started releasing the past two years balance sheets. Before July we could only speculate what UTMB was generating through the partnership with Ironman, and how much Ironman spent to acquire the 40% share of UTMB Group from Groupe Telegramme, the french press group that were their previous partners, and the extra 5% acquired from the Poletti’s share.

Now we know.

€12.4M, valuing UTMB Group at the time of acquisition in 2021 at €27.5M. The last valuation we have from Ironman France’s balance sheets puts the value of UTMB Group at €34.4M at the end of 2021, showing a growth of 24% in less than 6 months.

UTMB Group’s revenue growth since then suggests that that valuation is going to be significantly larger today. At the end of 2021, UTMB group generated €3.5M of revenue; in 2022, that rose to €10.2M, a 291% growth.

Now here’s where it gets complicated. That’s not even how much money UTMB Group as a whole is making. As a result of accountancy magic and willful blindness, that turnover doesn’t account for all the subsidiaries UTMB have made over the past couple of years, or what Ironman has generated in their side of the business.

To grow outside of France and manage the countries that UTMB Group organise, they created four subsidiaries; UTMB UK, UTMB Iberia, UTMB international and UTMB Asia. Some of these were created around the acquisition of race series from different companies, for instance InAran Sports, who own Transvulcania and Val d’Aran, were acquired for €530K.

There is also LiveTrail, the GPS tracking company founded by Isabelle Viseux-Poletti, who now is director of UTMB France (also Catherine and Michel’s daughter), and Poletti and Associates, a subsidiary that hold the Poletti’s share of UTMB Group. When all of that turnover is added up, that brings the total to over €14M generated in 2022.

When it comes to Ironman’s share of the pie, Frederic Lenart claimed in an interview last week that UTMB Group doesn’t monitor how they’re performing financially, they only assess how many runners have registered for their races. With Ironman controlling races in North America, Oceania and parts of Asia, that’s a large part of the business that we don’t know about. We might find out more when Ironman France release their 2022 balance sheet, but it’s fair to assume the value of UTMB Group as a whole is likely much higher than what it was in 2021.

UTMB Group’s revenue has two main tributaries, registration fees and sponsorship (media rights was not mentioned as a revenue stream by Frederic Lenart when i spoke to him, giving an insight into the value of the Outside and L’Equipe streaming deals). These two both have grown from the number of races UTMB Group it has acquired or created raising to 20 (Ironman own the remainder of the 36) and sponsorship endemic and non-endemic spots being filled, their Dacia and Naak deals being the most recent examples. Respectively, if we are to take Catherine Poletti’s stated proportions of 70% registration, 30% sponsorship, they attributed €7M and €3M to the final turnover.

Frederic Lenart added an interesting stat: From 2021 to 2022, the number of runners registered for a UTMB race increased by 50% year on year. I thought that was pretty impressive at first, but the difference between that number and the 296% increase in turnover suggests that the price of registration fees, as well as the number of places, played a significant role in this growth. This is nothing new for anyone who has attempted to register for a UTMB race in the last year. However, while the supply of places in each race has increased, the demand for those spots is so high that UTMB has increased fees, resulting in a surge in UTMB registration revenue.

Consider also that Frederic mentioned in Matias’ ‘Singletrack’ podcast last month that registration fees cover the cost to put on the race. This number in theory should only grow if more races are acquired or created, or registration fees are once again lifted to test what the adequate pricing for these events is. Isabelle Viseux-Poletti mentioned in an interview earlier this year that they are exploring growing into Eastern Europe, expanding the World Series to 50 races and increase the number of places per race to 5,000, all meaning registration revenue is only going to go sky high.

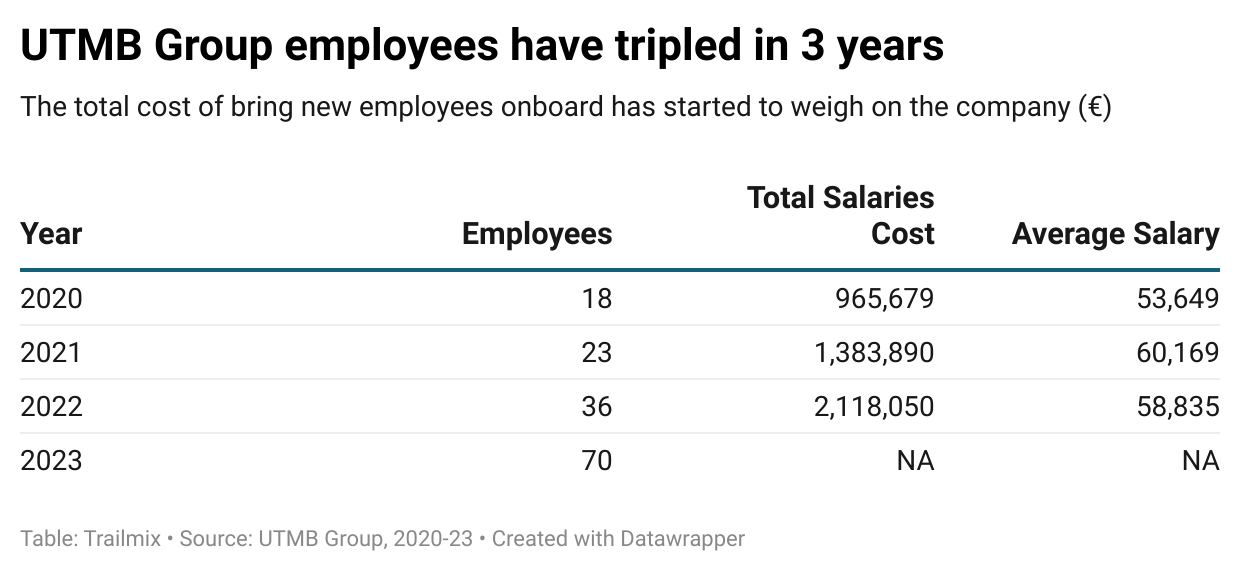

In spite of all this, for the past 4 years, UTMB has not been in profit. Initially this was the COVID impact, reducing the number of events they held and then in 2021 they lost a sponsor for UTMB Mont Blanc. Since then one of the main contributors to their expenditure has been salaries.

The number of staff has grown from 18 in 2020 to around 70 in 2023 to cover the organisation of the portfolio of events, but also to build out their marketing and operations team. According to the balance sheets, the average annual salary has maintained around €60K between 2020 and 2022. Frederic highlighted in an interview that he expects there to be growing efficiencies with resourcing, stating that you need the same number of people to manage 25 races as you do 40.

What was noticeably small in their balance sheet was financial debts, such as loans, which has been consistently small. Typically in a company growing this fast you would expect to see short and long term financial debts accruing with interest rates compounding on an annual basis, but in this case UTMB has been shrewd with their budgets, and been able to resist the temptation for easy money.

As such, when I asked about whether UTMB had been effected by the wider macro environment, Frederic Lenart confidently stated that it hasn’t effected the business or the sponsors they have been in contact with.

With less debt, UTMB is more resilient to volatile macroeconomic changes, but his statement and the balance sheets themselves suggest that the demographic that is signing up for ultras is also less impacted. This lends credence to the thesis that trail runners, on average, have a higher income and are less affected by fluctuations in the cost of living than the general population.

Evidently, ultra running is not a small industry anymore and UTMB is at the heart of it. Through global expansion fuelled by the Ironman partnership, UTMB is a significant beneficiary and creator of the money that flows through the sport. Isabelle Viseux-Poletti estimates that eventually UTMB Group could eventually earn up to €50M in turnover.

It’s always interesting to consider those “Sliding doors” moments after the fact, the moments where if another choice was made, we wouldn’t be where we are today. For UTMB, as these balance sheets show, it was the decision to partner with Ironman that sparked this growth.

When I asked Frederic Lenart about whether UTMB Group could have been this successful without Ironman, he quickly stated “No, I don't think so.”He went on to explain that “we didn't have all all the skills or the the expertise; we didn't have the financial resources to manage this expansion… we would have done something but completely different probably”.

Excellent report; thank you.

It's interesting when a business itself goes viral. I was at the UTMB World Finals start line yesterday - everyone knows it's big - it was bonkers. This is Tour de France level spectating - 4 spectators deep for the first 2km. Even the runners were filming themselves. It's like the Lance years when non-cyclists became fans - the thousands of spectators are not all runners.

Corrine and Scott are doing a good job on the English stream, but I waiting for Phil Liggett next year.

very good summary. we covered it on our podcast One More K, Episode 4 :) -> www.onemorek.com