36// Altra’s Alterations & Trail Running Bubbles

A Trailmix of news, quotes and ramblings about trail business

Hey pals,

I realised I’ve been doing this for over a year now. I know it’s customary to do an annual review and say how far we’ve come, but I’m British and talking about yourself is not the done thing.

I’ll say this - It’s been a pleasure meeting, chatting and learning from you bizarre individuals who share the same interest in talking about the business of trail running. I look forward to the next year.

Onwards,

Matt

Altra tries to escape its niche

When the news that Altra had launched a 4mm shoe drop and our industry press published the same PR piece I initially dismissed it as a nothing story - shoe company releases another shoe.

Only when the news is placed in the context of Altra’s business does it becomes interesting. For behind this line extension is a positioning strategy that seeks to reimagine what Altra is to runners and gives them a path out of just being makers of ‘zero drop’ shoes.

Altra have always gone after a niche runner. They’ve been the shoe for people that believe in their philosophy that it’s unnatural for humans to run with a drop in your shoe. After the “Born to Run” hype train pulled into town Altra’s popularity soared in the US, capturing the imaginations of many trail and ultra athletes alike.

The issue is that by going all in on a particular product niche, there will always be a ceiling for how much you can grow. You are at the mercy of runner’s preferences.

Altra attempted to reposition zero drop to ‘balanced comfort’ and had multiple line extensions to capture hikers, ultra runners and trail runners in various running scenarios. However at the same time, the preference for zero drop quickly peaked after shoe preferences changed with the growth of On and Hoka.

Over time Nike and Adidas have decided they too want a slice of the trail running pie and challenger brands like Norda and Speedland have become the new kids on the block, leaving Altra in a squeezed middle.

It’s a precarious place to be - no longer a young exciting brand that is attractive to many runners, not premium enough to develop high margins and not big enough to command sizeable budgets to compete with the mature players in footwear. Larger investors have seen potential in Altra after it’s been acquired twice, but it’s success has yet to materialise.

According to data from last year that showed the market share of running shoe brands in specialty running retail in the US, Altra came last with 4.8%, being outcompeted by Oofos with 5%.

VF Corporation, Altra’s current owners, are also in a bit of a tight spot. Their sales are currently down after Vans, the largest brand in their portfolio, is struggling to find it’s cultural stride. Altra’s revenue is too small to break out in VF’s quarterly reports, but you only have to see the headline numbers to sense that there is a pressure to perform and being a niche player will no longer cut it for Altra.

The problem’s then are twofold - one, the product is limiting growth, two, the brand is struggling to be heard in a very noisy market. Hence, the arrival of the 4mm drop and ensuing portfolio brand positioning piece.

Many won’t have caught the portfolio re-positioning (it’s not something many find interesting) but without this the 4mm shoe wouldn’t make sense for Altra.

Brian Beckstead, Altra’s Strategy Lead, explains it like this:

“Historically, it used to be neutral versus pronation. Then it was minimal versus max. What we were trying to do with our consumers now is talk about our shoes in terms of how they’re going to feel or experience the shoes. We’re dividing that into four silos. This is our Fwd silo,” Beckstead said. “What this shoe does is rockers you forward, you feel that that experience. It rolls you forward.”

He continued, “Then, we’re going to go with Feel. That’s going to be your Escalante, your Lone Peak and your Superior. Then, it’s Float. That’s your traditional higher-cushion Altras like the Torin or Timp or Olympus. Fwd, that’s going to be this shoe. And the last is Fast.”

Positioning isn’t just moving the furniture to make the brand feel different. It’s a reflection of their understanding of the audience, the marketplace and the brand’s ambition for how it seeks to grow. Altra sees the future of running shoes about how they feel to run in, less about pronation and cushioning. This prediction has fed their portfolio positioning and given them space to grow into low-drop shoes.

The positioning is smart. It’s a colour by numbers running guide for the everyday runner- do you want to float or flow? Rock forwards or move fast? It’s less technical than their previous positioning and moves them out of the specialist runner territory they were stuck in. The addressable market is larger and you become more welcoming to newer runners.

This of course comes with multiple flags - you have to make runners and retailers believe in the new positioning and as the framing moves against category convention of cushioning and drop, it’s going to require a big marketing investment. Additionally the product category is hardly new, Topo has been there for a while with a wide toe-box 4mm shoes. But if the risk pays off, it could be a rebirth for a meandering brand.

Trail Running is Frothy, not Bubbly

Dylan Bowman said the thing you’re not meant to say if the thing is actually happening.

In a podcast this week with David Callahan and Jay Kelley of UltraSignUp, Dylan lobbed a hand grenade into the discussion - is trail running as an industry in a bubble?

Dylan’s case, which he explained in more detail in the Freetrail newsletter, was that trail running has seen significant strides in race participation and economic investment from a growing number of brands over the past 15 years and he questioned whether that was sustainable.

Most don’t know when they’re in a bubble. It’s often discovered through a mix of vibes and data. When looking for bubbles you’re assessing whether the hype has driven valuations above the fundamental price of an asset. In the case of trail running, if there was heady speculation then brands and RDs would be raising prices of their shoes and races case in an excessive fashion to capture the perceived future valuation of the sport.

Which as far as we can see is not true.

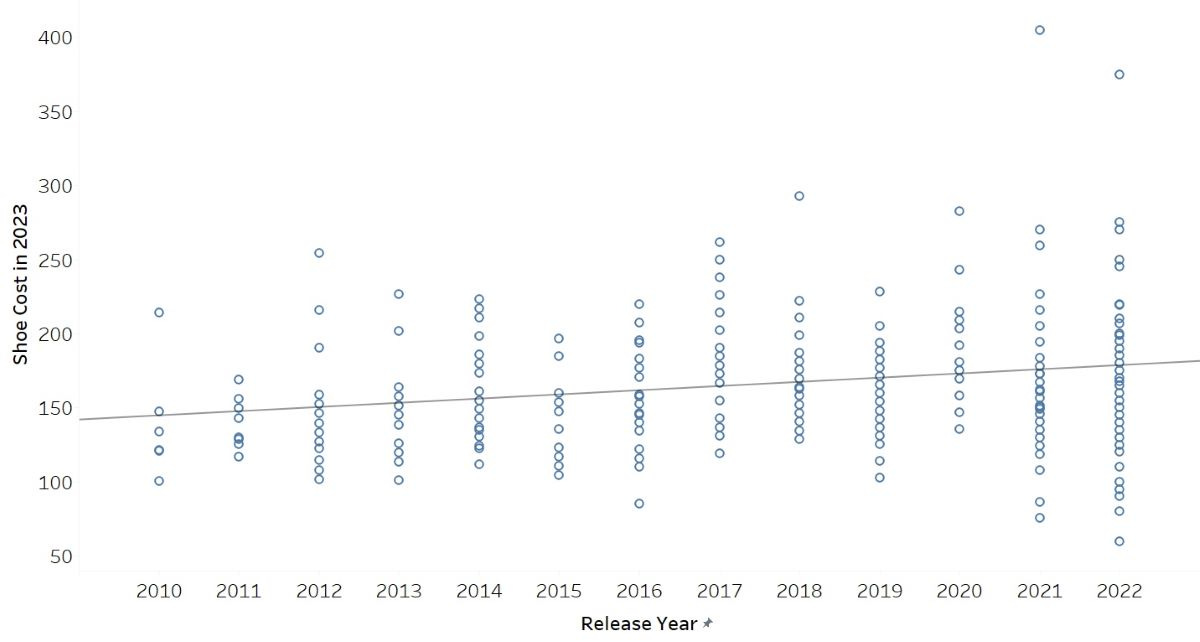

Yes, prices of trail running shoes have increased above inflation according to this excellent article by Mallory Richard, but it’s a 3% rise in price in 10 years, which can be attributed to increased range of prices and technology.

There aren’t many datasets on the price of trail races over time, but according to RunSignUp, the average price of ultra’s has decreased 4% (driven down by backyard and virtual events) in the US, which is significantly below inflation.

Both source dataset’s are hardly robust, but they give an indicative picture that there are no signs of excessive speculation in the industry.

David and Jay came to the same conclusion using their data from UltraSignUp, but raised an astute point about the need to focus on the retention as well as the attraction of more runners to trail running. "If we don't figure out how to support the runners... we do run the risk of seeing a contraction in years to come.” David said “Brands and content creators are always thinking about the next customer. We've got a lot of customers here that we're not doing a great job of taking care of right now."

Andy Jones-Wilkins added on X (Twitter) that the trail running industry is in the ‘experience business’ and the way to sustain the community was by nurturing relationships.

Whilst Dylan’s questioning seems premature, the industry is certainly frothy. If the industry is to grow sustainably is the role of retail, tech and race companies to be focused on the experience of the trail runner? Altra’s new positioning certainly assumes so.

Other News

Trail running is Nike’s fastest segment of growth in the running category, seeing double digit growth over the past quarter, according to Nike’s Q1 2024. More broadly Nike’s growth was stale with a mere 2% year on year increase, demonstrating even the biggest brands will struggle in this inflationary environment.

On’s almost reached $2bn revenue two years after its IPO, and is looking to double this by 2026 according to its three year plan. Whilst a giant leap, it’s easy to see this happening when their brand awareness is only at 9% in the US.

On the “running as experience” theme, the US Running Industry Association found in a survey that younger runners “take a more social and less competitive approach to running versus older generations.”

I've been missing this for a year, but better late than never! Keep it up, Matt!

Congrats on a year done!