Hey pals! 👋 It’s back to 80 hour weeks at work so I haven’t had time to write a good ole’ essay for you lovely folk. Regardless, we’re back with trail running news. Hope you enjoy this one. I’m in NYC for the next two weeks for work, so if anyone is around let’s meet up! However it does also mean I won’t have time to make the next newsletter on time. I’m sure you’ll all live. Onwards. - Matt

Arc’teryx spreads its bony talons into new footwear

What? Arc’teryx are releasing new trail running shoes designed and built by their internal for the first time.

Previously Arc’teryx relied on their relationship with Salomon via their parent company Amer Sports to design, manufacture and distribute their footwear line. This meant that Arc’teryx used the same lasts and technology as Salomon but with Arc’teryx's brand look and feel.

Why tho? The growth further into trail running allows them to grow their revenue in summer and spring months when their core outerwear sales decline, reducing seasonal variability.

In an interview with CEO Stuart Haselden this week on Arc’teryx’s growth, he mentioned how central footwear is to their strategy and how they’re now in a position to cement their position in each of their categories.

“I think we're in all the categories we want to be in,” Haselden said. “I think it's more about how do we develop our position and our execution and our product assortments within those categories to really achieve our full potential.”

The plans - the new footwear will be built around taking an athlete from the foot of the mountain to the peak without changing. Ovidio Garcia, VP of Footwear, mentioned that the driver for this came from how shoes are currently designed for each mountain discipline individually rather than holistically

“The outdoor world is siloed in terms of activities. When you talk to an athlete that plays in the mountain space, they hybridize a lot of the activities.”

Matt's opinion: Arcteryx have been in trail running for a few years now, slowly growing their portfolio, but they haven't gone as deep into the sport as they have done climbing. Without the experience in the category, they haven't innovated in the same way as their outerwear.

However there's a lesson in brand extensions in here that even the non-marketing person can identify - when someone goes so nerdy into a topic area, fussing over the detail, becoming experts in their field, you trust them. They give the appearance that they care and know what they're doing.

The same applies in marketing. Arcteryx have become the brand for technical outdoor wear; they're trusted. When you build your brand around essentially being nerdy, you can extend that perception more easily into any tangential category. But, you need to also be nerdy in that category too. Hence, this move by Arcteryx is to do just that - they recognised it's not in their brand DNA to scratch the surface of a category and not invest in being the best. With this investment in building out their footwear line-up and team, it allows them to become a trail running brand, just like Salomon is too. If they're shoes become anything like their coats, i'm excited.

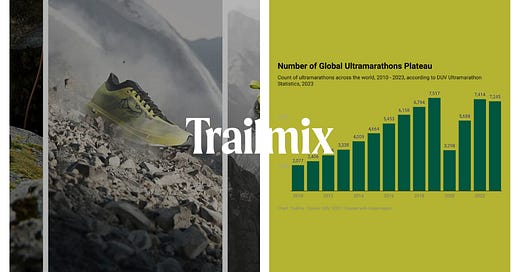

Ultramarathoners finally run out of gas

What? The number of people competing in an ultramarathons, and total races in general, plateaued in 2023, failing to reach 2022 or pre-pandemic numbers, according to DUV Statistics.

Go deeper - participation at most distances of ultra marathon have not recovered back to pre-pandemic levels apart from 100 milers that are 5% above 2019.

Not only are less total people competing in ultramarathons, but people are competing in less races per year than 2019, down from 1.63 races per year in 2019 to 1.56 in 2023.

This is not the same in all markets. In most major trail running markets, such as North America and Europe, the number of races was stagnant but participation was up on 2019 levels.

Big picture - On top of this the number of searches for ultramarathon related topics has been stagnant over the past 5 years worldwide. This is the case for most major trail running markets, with spikes in searches around the Gansu Ultramarathon tragedy and celebrities running ultramarathons for charity.

(for the brits reading, Vernon Kay, TV and radio presenter and smiley man, caused the biggest spike in searches for ultramarathons in the UK that Google has ever recorded.)

Counter-argument - the subreddit r/ultramarathon has seen it’s growth skyrocket since the pandemic to 119K, suggesting greater community interest in the US. However, this could be due to Reddit’s push over the past few years to increase it’s audience size and engaged user base to prepare for it’s IPO that came out this week.

Additionally, the DUV statistics are compiled by volunteers manually uploading the races across the world in one dataset. As such, they might have missed some races last year.

Matt’s opinion: There’s several implications of a plateau in interest.

With numbers of competitors plateauing, that means the total audience size for large scale race organisers like UTMB and WTM has not changed. However with UTMB growing it’s number of races that means UTMB’s market share will increase.

For individual race directors fewer competitors racing less means a greater competition for people, and with UTMB’s market share growing, that could result in more race directors going out of business. Those that stay in business will need to increase their marketing spend/time to compete for runners or diversify out of ultras into sub-ultra trail running.

There aren’t many apparel or footwear companies that specifically tailor themselves to the ultra running audiences, so they’re unlikely to see much change.

Equipment sales may change, but considering the industry is going through a whiplash effect from the heightened high value sales they pushed in 2021/2, this is unlikely to change the bigger picture.

(As we’ve covered in previous newsletters, the apparel and footwear businesses have been saying in their quarterly reports how trail running more broadly has been one of their biggest growth sectors, so let’s not worry too much there.)

There are only a few media outlets that cater specifically to ultrarunners, but for them eyeballs is everything. Less people equals less ads seen. They’ll want to raise their prices (CPM) to keep their revenue the same, but thats a hard argument to make when your ads get less exposure. Even subscriptions rely on retention and hence they may risk the bet that many ultrarunners haven’t heard of them and continue their acquisition strategies or double down on their current subscribers to try to keep them subscribed. When your resources are minimal, you reach what they call in chess ‘zugzwang’ - a position that whatever move you make your condition will worsen.

From a marketing perspective, regardless of whether you’re an RD, apparel or equipment manufacturer, a stagnant market suggests there could be a greater focus on retention than acquisition strategies (so more emails for you lucky runners). When the size of the market doesn’t grow, its a scramble to maintain your current share of business, a place that no marketer wants to be in.

Ultimately, a stagnant market is exactly not what anyone wants.

However, I’ll throw a MASSIVE caveat that this is based on numbers from one source, this is not happening in all markets, this is only one year and we’ve just come out of a world-changing pandemic. If someone has more robust data, please send it.

You can see though the significance of knowing the audience size and its growth is to an entire industry. Your perspective has to change, your strategies shift and you start looking more at your balance sheet on a daily basis going ‘holy shit’.

Reddit growth is also affected by a partial merging of two boards last year, FYI. It was more than just general sport growth.

Long, silly story but I actually mod that board and am very familiar with the practical change in the userbase.